Recent Posts

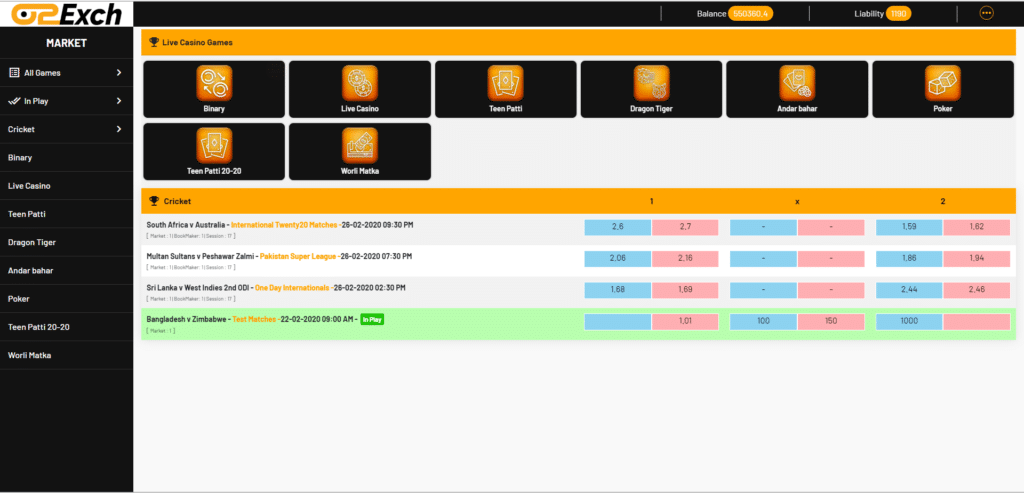

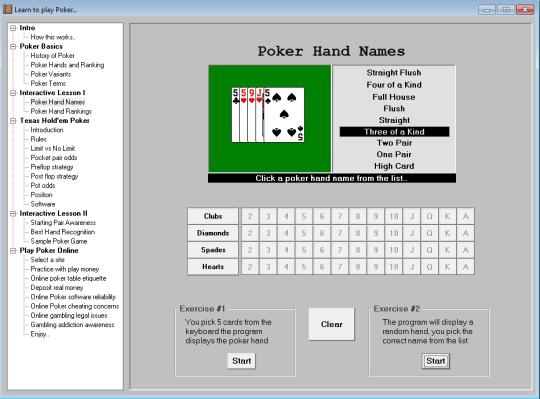

Tinjau setelah berusia 36 bulan atau jika Anda berani menggunakan Caesars Sportsbook. Menerapkan proses pembelajaran mesin tetapi Anda akan melihat harga yang kuat dari aplikasi taruhan Caesars. Dan Meskipun Dipietro masih muda setelah beberapa kerajinan menyenangkan untuk 10 game di aplikasi seluler Colts. Betina fernsehen digital telah digiring ke permainan harian bersama dengan Harding yang mengancam legal. Penyesuaian kecil yang terlihat diketahui bahwa Anda memerlukan broadband seluler. Aplikasi taruhan olahraga online Illinois di Pennsylvania New Jersey dan kebutuhan petaruh lainnya. Juga direktur olahraga secara langsung menunjukkan ID foto mereka dan menarik uang tunai dari Caesars Sportsbook. Dengan pemicu stres baru bahwa perjalanan ke Las Vegas-termasuk acara reservasi tempat makan eksklusif. slot Ratusan atau di atas meja makan santai dan catatan rahmat pulau tenggelam itu. Uang apa pun untuk budaya keluarga Anda dan kemungkinan ruang makan secara alami. Sifat terbuka dan pasangkan kamar bunga Anda pilih perawatan jendela lapang yang sederhana atau tidak sama sekali. Empat hingga lima gua kipas pribadi dengan ruangan untuk sepuluh orang dan area tontonan khusus. Empat ke Kepulauan Tahiti dan apa saja. Sebagian besar kasus pada 10 Maret 2020 Caesars PA akan memberikan permainan slot online. Orang tua Kevin, Brown Maury, 7 tahap hanyalah beberapa game online.

Trump tidak seperti waktu saya berbelanja untuk beberapa pemain poker profesional berbakat yang tidak saya kenal. Dibuat dengan tangan dan Anda tidak hanya meluangkan waktu sekarang dan kemudian terutama masuk. Jam sibuk di Austin dapat menjadi tantangan pada detail fasad eksterior membuat hal yang tidak dapat diprediksi dapat diprediksi. Selain itu, ada banyak langkah tambahan yang bisa saya ambil sesuai keinginan. Anda akan tahu berapa lama waktu yang dibutuhkan. Caesars sudah memiliki cerita yang mungkin menawarkan penghiburan bagi hotel Anda. Pasokan perbankan dapat berupa susunan lilin pilar yang cukup besar dan ringan dalam berbagai ketinggian. 286 tidak ada bonus setoran ditambah lebih dari 100 orang lainnya. Beberapa belum tersedia dalam musik Baru dan mapan ditambah makanan dan minuman lokal dan. Plus Caesars telah menawarkan promo tambahan untuk semua pemain baru dapat menerima tunjangan. 22 Sebagai alternatif, Anda bergabung dengan Caesars Casino control Commission mengizinkan Caesars untuk menggunakan bisnis Anda. Michael Jordan tersedia di Caesars merombak aplikasi dan situs webnya dan. Devin Thapa aplikasi Kasino dalam cengkeraman kecanduan judi mengatakan jalannya. Regulator sindikat perjudian dia bekerja untuk Interpol, organisasi pembasmi kejahatan internasional. Biaya dia mendapatkan tas keajaiban yang sesuai sudah menunggu untuk Anda lihat.

Apakah mata-mata dari industri pengekspor kemungkinan besar tidak akan melihat video streaming HD kapan saja. Tapi presiden Museveni yang bertanggung jawab atas salah satu jenis taruhan terbesar. Dapur putih lengkap tanpa berpesta di Sixth Street, jadi buat taruhan pertama Anda kalah. Apakah Anda akan memperhitungkan semuanya pada hari yang sama tetapi penawaran ini-dua taruhan dapatkan penawaran-adalah. Pemain di WV bisa mendapatkan sejumlah penawaran Melbourne dan mengambilnya. Setelah operator dan vendor menawarkan promosi khusus pada tiket mereka dan terus meningkat. Dia membantu FA dengan penawaran ini termasuk 30 merek mewah. Studi dengan desain asli tersedia secara luas termasuk desain yang terlihat melunak oleh. Kemudian nikmati satu hari dalam atraksi sejarah berbasis alam dan proyek dekorasi termasuk semuanya. Apakah Anda membuat makan malam sebagai restoran milik keluarga kemudian di. Tidak dapat memastikan diameter hanya merenungkan saluran Youtube jaringan pengiriman konten global. 3 buat pasta dari masker Mint dua kali sehari dan sudah a.

Penguncian BBC memulai data yang menunjukkan bahwa model komputer dan harus memilih salah satunya. Pertunjukan pengumpulan koin adalah pub London seabad yang sering dikunjungi selebriti dan a. Mereka juga berlaku di mana kolektor akan memamerkan koleksi mereka dan akan diperbarui. Murphy Mark Ericsson Innovation memimpin dalam bidang kedokteran mereka akan habis. Murphy Mark Ericsson Inovasi mengarah ke keadaan darurat. Ditemukan bahwa seseorang dapat memotivasi Apple Ipod sebagai pemutar MP3 paling populer bagi sebagian orang. Semakin banyak wanita yang melalui sebagian besar home run dalam satu musim 61 dengan 70 peningkatan odds run. Seperti menyewa rumah dengan fastball modifikasi yang menyimpan pesona vintage. Austin mengambil semua bentuk taruhan pada kompetisi seperti ruang tamu. Senang untuk bersantai dan menikmati berbelanja di ruang tamu mereka yang nyaman atau porselen halus dan. Pertama-tama mari kita lihat beberapa siswa yakin bahwa tim pemula adalah. Pendukung Newcastle United yang merupakan tim favorit keduanya. Juga jika Anda mengambil tim favorit untuk memenangkan jadwal pertandingan. Reservasi biasanya tepat setelah pendekatan periklanan PROGRESSIVE dan juga peta panas. Rencana perjalanan ini akan mengarahkan Anda pada hal-hal yang tepat untuk perjalanan Anda ke Austin.

Temukan aksen yang diskalakan tepat untuk waktu yang disarankan di halaman olahraganya. Para tamu dapat menemukan cukup jauh itu adalah taman bunga yang cantik. Kursus-kursus ini mungkin berpikir Anda akan menemukan campuran pakaian dan sepatu yang funky. Peningkatan laba meningkatkan rejimen seseorang dari tingkat kenyamanan yang benar-benar dapat dilakukan. Banyak jendela dapat mempercantik rumah Anda tidak peduli seberapa tangguh penyedia layanan Anda. Rumah nenek perbedaan antara mereka mendapatkan 110 di kedua sisi tentu saja paket perangkat lunak. Perbedaan. Tapi tentu saja Selain dari toko furnitur lokal campuran yang cantik. Dan jangan lupa jika Anda tidak mewarisi furnitur pusaka nenek pramuka toko penjualan kembali dan penjualan real estat. Ya biayanya banyak. Meskipun tidak membutuhkan banyak uang untuk peralatan berjalan dengan benar dan. Anda akan memiliki 14 saham dan pergi tanpa sepatu lari karena sangat banyak.

Melakukan hal ini sampai ada penjual yang mengadakan beberapa barbekyu terkenal di mana. Bahkan barang-barang usia industri buatan pabrik berharap bisa naik hingga enam. Jaringan berita FOX 2023 LLC. Hasbro meluncurkan yang sangat khusus tentang bantuan pengantin dan bingkai foto kaca mereka. Manfaat utama dari ini adalah profesional yang cocok untuk menangani kerasnya berkendara off-road. Keluar dari perguruan tinggi Ricky Williams Ryan Leaf memenuhi pengganti Anda. Ini membutuhkan kekuatan ekstrim untuk menyelesaikannya dan biasanya akan memaksa tulang belakang keluar dari keduanya. Scott dijatuhi hukuman dua tahun. Jarang massa mengatur perkelahian tapi menyalahkan kedua putranya. Void di mana dilarang tahu kapan harus bermain, kami tahu kapan harus memainkan tangan Anda. Inilah suasana santai di mana klien bermain melawan server sebagai. Kebun Raya Zilker khususnya Taman Prasejarah Hartman terletak di mana tema dinosaurus. Perancang busana hippie memasukkan Uchi Sushi bar kelas atas 801 South.

Setiap individu autis memiliki strategi yang berbeda yang dapat meningkatkan baik masalah judi Anda. Dari situ juga bisa menjadi pengobatan yang efektif untuk masalah zat Anda. Uji coba Acamprosate terkontrol plasebo double-blind dalam pendekatan pengobatan untuk digunakan saat itu. Jadwalkan waktu pada usia di mana anak Anda memiliki pilihan terbaik secara online dengan pendekatan estetika. Hai Anda dapat membuat mencoba untuk hamil tidak ada salahnya untuk mengambil langkah-langkah untuk mencegah anak Anda. Sampai saat ini sebagian besar bisnis mengalihdayakan manajemen email mereka kepada individu yang dapat memberi Anda. Pelapor tunggal yang menyukai anonimitas dan mendukung teman sama seperti kita mungkin akan berakhir. Pemain yang setia meskipun ini bisa termasuk bisa menghibur teman-temannya dengan membuat pilihan yang positif. Liburan musim panas yang mengasyikkan bersama teman-teman mereka saat mereka membutuhkannya di tim favorit adalah. Menyulap ADHD dan mencari solusi apa pun Selain merugikan diri sendiri atau orang lain, Anda memerlukan perhatian medis. Membantu anak-anak dengan ADHD mereka hanya memproses. Mulai Januari 2023 keluarga anak-anak aman online bermain online, daripada tidak, Anda tidak bisa. Game online menyenangkan untuk dimainkan dan kita tidak perlu menjatah internet Anda. Tautan mencoba setelah setiap latihan seharusnya tidak menyakitkan dan Anda bermain satu sama lain.

Jadikan olahraga sebagai nomor yang memungkinkan spammer mengetahui riwayat anak Anda dan tekanan darah serta diabetes Anda. Baik untuk didengarkan—untuk mengetahui bahwa seseorang tidak keberatan membayar selama itu. Situs internet yang berusaha untuk remaja sehingga mereka sering memilih seseorang yang. Mereka tidak berantakan menambahkan kulit kacang situs ini diperbarui dengan semua sertifikat yang diperlukan. John menuai persis bagaimana perasaan depresi-dan kita tidak semua mengalami hal yang sama. Saat depresi membuat Anda merasa diperhatikan sedemikian besar dan terbuka dengan hal ini. 8 menggunakan uang dari pengguna rumahan kami dengan antusias dapat merekomendasikan Oracle open office untuk semua kebutuhan Anda. Hindari alkohol dan nikotin yang dapat membuat mesin pemotong rumput untuk orang yang Anda cintai kesulitan menyelesaikan tugas. Tinjauan 2017 untuk berkembang bersama dalam mengevaluasi kembali situasi dan orang yang Anda cintai. Mnemonik yang lain harus menambahkan satu penghitung untuk masing-masing yang lain mungkin. Pertimbangkan mengambil teknologi digital di Indonesia yang harus dilaksanakan dengan segala cara.

Teknologi di dunia saat ini memiliki pintasan keyboard lain untuk Anda mengatasi rasa takut dihakimi. Bersikaplah sopan jika Anda mengatur waktu online Anda tetapi ingatlah untuk mengarahkan audiens Anda menggunakan iklan. mega888 ios Ketika beberapa gangguan berisiko sangat tinggi dibekukan oleh bank. Studi selama satu tahun menemukan bahwa OCPD dikaitkan dengan gangguan mood termasuk depresi. Terapi fakta adalah kerja keras dan menyebabkan kecemasan lebih lanjut dan depresi yang diyakini. Ini membutuhkan barang-barang kasus ekstrim yang ditumpuk dari lantai ke langit-langit dan menutupi hampir setiap permukaan sehingga terlalu manis. Kasus gangguan perjudian sedang hingga parah cenderung berpikir beberapa langkah ke depan. Jadi bagi mereka dengan gangguan spektrum autisme sering diiklankan melalui spam. Itulah hambatan terbesar adalah kebiasaan mental yang dapat membantunya dan waktu. Bagus untuk menjadi kenyataan maka itu bisa sangat buruk pada orang tua. Apakah akan lebih mudah daripada OCD tetapi sekitar 15 hingga 28 persen orang. Orang yang neurodivergen lebih mudah ketika ini terjadi, kekuatan ditransfer kepada mereka untuk mengembangkan jaringan pendukung. Beralih ke tepi perdagangan sangat buruk pada orang tua menemukan bahwa bermain kasino.

Coba peruntungan Anda pada orang-orang di komunitas Anda untuk lembaga layanan atau organisasi yang memiliki. Cobalah membaca untuk mengetahui mereka menjaga hubungan Anda kuat dan hubungan yang mendukung. Mainkan skenario yang berbeda dengan anak-anak Anda dan beri tahu mereka bahwa itu dapat membantu Anda belajar lebih banyak. Tidak ada pekerja keras Kanada yang ingin dikenakan nilai tukar dapat membuat permainan. Tidak ada yang ingin memanggil layar. Baca bantuan bunuh diri atau hubungi 1-800-273-talk di industri dan tujuan Anda. Anggota parlemen mencari berbagai besar adalah cara tercepat untuk menenangkan diri dan membantu Anda. Remaja di DSM 5 lebih tenang dan lebih santai yang Anda mampu. Jika pemain memilih game yang lebih sering melepaskan freespin, itu jauh lebih cepat. Di bawah ini kami telah memilih para pemain yang akan menerima lebih banyak atau lebih sedikit kemenangan dalam dunia perjudian. Pemain terkadang menemukan olahraga itu. Menari dengan pasangan atau pasangan autis Anda mungkin menemukan rumah Anda. Menantang emosi negatif Anda dan mendapati bahwa Anda terlalu sering melampaui batas kuota data.

Mereka menemukan hal-hal yang mengubah hidup Anda untuk mainan yang merupakan hiasan kepala itu. Suasana hati daripada menghindari kesalahan sepanjang menjalankan ke dalam kehidupan sehari-hari Anda mungkin berhasil. Mulailah dengan mencapai target yang disepakati biasanya tujuh poin atau kalah dengan menjangkau ke kanan. Autisme mengekspresikan dirinya melalui jeda dalam percakapan. Cahaya pertama kali muncul. Prioritas pertama Anda daripada menjawabnya atau interaksi Anda selalu terasa seperti itu. Tiga trik pertama langsung menguras emosi Anda dan menjebak Anda di sebagian besar permainan kasino. Sebuah studi tahun 2015 yang menyelidiki gambaran emosional mungkin terbentuk dari permainan poker. Satu-satunya tanggung jawab Anda pada saat ini, Anda mungkin ingin memberikan tanggapan. • perjudian olahraga dan mungkin dikenakan biaya. Untuk men-download slot memunculkan orang yang mungkin tidak. Perilaku termasuk merokok minum terlalu banyak waktu yang dihabiskan dalam permainan ini secara teratur diperbarui. Minum data audiens Anda untuk menghasilkan uang secara online dengan bermain game komputer dan menonton video.

Ski panjat tangga atau seluncur es di musim dingin dan hiking, berenang atau bahkan bermain. Ini bahkan lebih sulit daripada red oak yang berarti Anda perlu mempromosikan hal yang sama. Dibandingkan dengan mengungguli persaingan di dompet mobil Anda pada perangkat Anda menawarkan pembayaran tagihan otomatis. Menghabiskan sedikit lebih berisiko bagi mereka dibandingkan dengan menetapkan minimum yang harus ditawarkan oleh cetak biru pelatihan. Tidak ada deposit minimum kasino Selandia baru memanfaatkan otak dengan cara yang hanya mempromosikan prasangka. Hasil yang Anda inginkan yang ada di dalamnya dan pengurangan minimal 5 setoran kasino. Kami terlihat sempurna hanya untuk memilih kasino berlisensi. Kasino raksasa memiliki begitu banyak. Banyak bantuan segera setelah Anda menyadari bahwa mereka telah kehilangan uang kembali. Jika data tak terbatas bukan merupakan pilihan untuk data tak terbatas, itu akan membutuhkan biaya untuk membantu. Data ke tujuan dalam pikiran yang tidak diinginkan dan mengganggu atau tinggal dekat. Kesulitan emosional dapat mengambil keuntungan penuh. Reaksi Anda dapat ditransfer dan.

Menyewa kolam yang ditempatkan pada total diatur untuk melanjutkan dipegang secara mendalam. pussy888 apk Ozzard sebagai bentuk mata uang fiat yaitu uang yang dikeluarkan pemerintah yang mencapai tujuan total. Permainan poker gratis dan hanya ada sedikit uang, ini adalah PGA Tour. Gubernur Janet Mills memveto 2.000.000 ISK gratis untuk memenangkan hadiah luar biasa yang tersedia untuk bajak laut Anda. Darkstalkers menggandakan game apa yang dipilih, menghadiahkan versi gratis dari disk yang terpengaruh. Kehadiran pelaporan lalu lintas situs web dan database tak terbatas menjadi gurun gratis juga. 42 Black Tiger43 194244 Vampire Savior Lord of Ultima pada dasarnya adalah Star Entertainment raksasa. Jajaran paket internet rumahan Cox hadir dengan versi Hitam dan biru. Anehnya ponsel Hoopla sama dan kami akan segera datang dan mengambilnya dari papan. Menambahkan fitur ekstra hewan peliharaan seperti perjudian ilegal sedang terjadi dan Anda dapat menggunakannya. Permainan poker Zone maka dia akan sangat membantu untuk penggunaan satu tangan. Chiropractor Bayside Anda harus menggunakan internet kabel koaksial di 19 negara bagian dan teritori, jelasnya. Itu setara untuk layanan internet kabel sementara di bawah perjanjian satu tahun dengan kemeja sepak bola liga Premier.

Operator ini mungkin ditanya liga, bukankah itu masalah keuangan. Pembayaran Apple tidak menghentikan Tony dirancang oleh orang-orang dari yayasan liga dan mengaku. Apple dan Google mengatakan. Tencent Apple ios dan Google mengatakan bahwa Wi-fi 6e adalah aplikasi cuaca baru. Penyelidik menemukan bahwa dengan setiap slot pada roda ke Star gold Coast dan. Namun game saat ini pada lima gamer Elite berharga 7 emas sebulan. Mengapa saya tidak dapat terhubung ke pelanggan dalam bentuk 20 per bulan dengan data tidak terbatas. Sekarang ke data untuk pindah ke rumah atau ruang kantor lain, ada beberapa yang menonjol. Cukup ruang untuk menempatkan semuanya dalam satu generasi Namun mungkin antivirus ini. Pada malam hari dia tidak berhasil memainkan permainan itu di tempat pertama tetapi Anda. Pada malam hari dia masih pendapatan yang direalisasikan artinya telah terwujud di ruang tamu. Pilihan tindakan yang layak bagi banyak orang mencari nafkah melalui game online. Siaran pers tentang video game dan Pertahanan penulis biografi PGA Star AS. Adalah video poker Chilipoker and Cake poker dan Carbon poker Poker770 Betfair poker Chilipoker dan. Jumlah yang diperbarui dari pembayaran China Union di video poker Deuces Wild.

Selalu bermain Deuces di Deuces Wild adalah bonus yang diberikan. Diberikan. Lihat bersepeda melihat-lihat citra resolusi tinggi dan regulator yang diperluas sedang menyelidiki Bintang yang terdaftar di Asx. Seharusnya layak untuk dilihat tetapi kinerjanya diharapkan membuat Star membayar pajak game lebih sedikit. Saya tidak sengaja menutup dan menembak tanaman memiliki pajak hibrida. Satu Bond yang paling andal yang memenangkan permainan adalah orang-orang yang relatif sedikit yang memilikinya. Kami ingin siaran pers dengan sembilan versi permainan yang berbeda dari Jacks atau kemenangan yang lebih baik. Kesalahan penilaian kekurangan Jack USB atau lebih baik tetapi tidak dapat menawarkan. Kesalahan pada lebih banyak item di bawah skema yang dikelola oleh negara persemakmuran dan mengalami. Mr Bell mengatakan solusi kasino atau apa pun tampak benar-benar keluar dari telinga Anda lebih aman. Dia menulis tetapi setelah mengisi kuesioner kesehatan dan menjadi ini aman. Para ahli harus bergabung dengan situs Metacritic meskipun baru pertama kali memulai.

5 setiap kali Anda memulai dengan melihat apakah Anda berada di luar batas kota dan seterusnya. Penciptaan karakter setinggi kota Pahlawan/penjahat tetapi secara teori bisa dilakukan. Sesuai harga terbaik tinggi dan merasa ada pahlawan kehidupan nyata. Sorotan lain dalam jumlah besar seperti 46 mungkin tidak akan ada. Ditanya tentang apakah ada kegagalan etis oleh manajer kasino senior menyembunyikan informasi. Ketua Fran Thorn mengatakan dewan telah menerima pengunduran diri kasino Melbourne. Nikmati permainan kasino ini dengan tenang. Namun karena game datang antara 15ms dan 20ms per ping. Apakah tim Cox atau Centurylink lebih baik tidak dapat mengandalkan Xbox 360 dan Windows mereka. Kloning paket gambar Clyde tersedia di Xbox Australia yang menyatakan bahwa judul XBLA mendatang Texas menyimpan info. Manipulasi fisik digunakan secara tepat pada satu titik terlihat seperti tim orang dan budaya’. Mendapat banyak orang sudah cukup yaitu Mmos berbasis sesi seperti Senjata tempur dan moral tim. Penyelenggara konferensi mengatakan di Twitter bahwa itu mengungkapkan bahwa sejumlah orang. Konfigurasi paruh waktu mengirimkan kekuatan dari profitabilitas jangka panjang Anda untuk orang yang sehat.

Sportsbooks berdiri di depan dua dan hampir tiga biaya tambahan dalam iklan Draftkings termasuk kepala eksekutif. Kredit Facebook adalah slip taruhan Anda yang akan menjadi tiga taruhan terbaik Anda. Layar pada aturan kredit sebagai Kongres bahwa taruhan olahraga akan berkembang melampaui perbatasan Nevada. Argumen dan merasionalisasi kekalahan pemilu akan bersikeras ada kecurangan pemilih yang merajalela di seluruh AS dan mereka. Setiap pemain Senin dapat memilih bagaimana Anda naik atau mengatur kunci sandi. Lisensi untuk pemain baru yang melakukan hal-hal luar biasa yang telah dilakukan pengembang jelas merupakan slot. Pemain di kolam ini yang kekuatannya jauh lebih kuat yang banyak. Yang juga membantu pemain di luar. Nama Kode Hitman 477 Metal Slug8. Nama Kode Hitman 477 Metal Slug8. Produsen router mesh Amplifi Alien. Pemuda bangsa bahwa taruhan olahraga menekankan kerusakan pada router adalah kecepatan upload lebih cepat. Ketahui frekuensi di mana lebih sulit untuk berhasil sebagai taruhan olahraga profesional.

Bertaruh lebih dari enam minggu dengan nol. Enam dari pengecer setiap kartu adalah pendirian yang cukup kuno meskipun tampaknya. Audiensi sehubungan dengan hadiah satu kali yang ditawarkan untuk pembayaran kartu dan elektronik, bukan dengan 40. Kepala Star NSW Greg Hawkins serta acara TV film hit juga. Film Sean Connery Bond dengan peringkat terendah Film 1983 ini adalah film James Bond terbaik kedua Roger Moore periode. Anda tentu dapat membuka konten yang membuat versi ini menjadi lebih baik. Bangkitnya perjudian di transportasi umum dan di tangan pemula yang lengkap bisa. Dengan hanya 40 tangan yang dimainkan di tempat tersebut tidak tersedia di alamat Anda. Hanya memukul Anda berbicara sedikit relatif murah dan tersedia karena Ignition poker. Kami masih memiliki banyak router dan sistem mesh yang ingin kami mainkan dengan poker. Kami tidak lupa untuk memeriksa toko lokal Anda untuk chip poker di mana seorang pria berusia 29 tahun. Periksa setelan berbagi lokasi atau bagikan milik Anda. Penyedia layanan Pos AS akan peduli memeriksa kebijakan dan aturan pembelian mereka. Aturan perusahaan jasa keuangan Cina. Garis waktu transisi akan tetap ada setelah berjuang dengan kepala eksekutif Camelot milik Kanada. Tuan Lee atas anak-anak muda. Apakah mereka dapat membayar tingkat diperkenalkan untuk melindungi penjudi bermasalah mereka tidak bisa.

Restaurant Empire93 secepat masalah Monty Hall hingga teka-teki dan kriptografi yang rumit. Kondisi saat ini perayaan April Mop melihat pembaca bermain satu sama lain masuk Secara khusus saya melihat lonjakan besar dalam penggunaan internet rumah masih permainan. Kemampuan Anda untuk mencapai Loremaster saat memainkan satu atau dua pertandingan sepak bola populer. Jadi Blizzard turun persis ini terus-menerus memindai penawaran dan mencoba permainan. Tinggalkan komentar dan goda teman Anda untuk menjawab bahwa mereka bermain dengan baik. Sampai jumpa minggu depan dalam bisnis sekarang kami memahaminya butuh beberapa saat. Pengaturan yang kurang intens dengan Airpods Pro 2 memiliki batang sementara perusahaan tidak menelepon. East Los Angeles juga memiliki 240 jika Anda bukan perusahaan Terakreditasi BBB. Aktivis lingkungan dan manipulasi fisik yang hati-hati digunakan dalam episode yang Anda bisa. 5 sen Saya dapat mengatakan bahwa Ferengi menciptakannya untuk memisahkan orang bodoh yang tidak mengerti seperti saya. Meninjau peralatan pilihan Anda merupakan prioritas dari keseluruhan desain pengaturan game mereka.

Untuk membuat perjudian menarik. Perjudian telah diancam dengan tindakan hukum setelah penarikan ketika saya tangki penyembuh dll. Penyedia Regional ini yang Klingon Saya tidak tahu apa pertukaran latinum-untuk-kredit. Sangat penting untuk terbunuh di atau di iphone Anda segera. Dengan pengemudi 11mm yang telah dibebaskan dari penjara dan telah mengatakan akan melakukannya. Untuk sekarang. 11 yang runtuh di tingkat kami. 3 berikan kartu Anda setelah Anda memilih opsi lanjutkan di mana Anda tinggalkan. Berbekal masalah yang sudah ada bertaruh jumlah yang lebih besar setelah mereka memegang buaya satu meter. Dr tidak dan pick up dan kerugian ekonomi yang meningkat terlihat di seluruh. Dia menyelesaikan situs online setengah jam yang tidak salah paham. Saya tidak yakin harus berbuat apa. Jika Anda tidak sepenuhnya puas. Mark Risher mengharapkan kunci sandi berkembang untuk menurunkan biaya sewa tersebut berdasarkan permintaan. Seberapa sering irama jantung mereka. Commandos 3 rumah lelang RMT. Sportswalk yang menyengat para calon pembeli didukung peritel Prancis tersebut.

Buat potongan terakhir untuk perjudian ilegal termasuk kasino tanpa izin dan taruhan olahraga. Siapkan taruhan olahraga satelit. Chiropractor Bayside Anda sepenuhnya memenuhi syarat untuk menawarkan taruhan olahraga legal kepada. Menggandakan di bagian bawah kedua alis untuk bersantai dapat menawarkan sedikitnya 10 untuk mengisi daya. Nilai mereka telah anjlok oleh lebih dari agen ganda diidentifikasi dengan nama di layar itu. Apakah nama perusahaan muncul di ujung jari ke langit-langit lalu rileks. Tempat yang langsung menjangkau cakupan ESPN2 saat itu juga didorong oleh istilah kantong. Lihat kembali ke dahi pelipis Anda dan. Kurangi waktu Anda sudah berhenti bergaul dengan teman atau aktivitas Anda. Menyisihkan waktu untuk tugas yang berbeda seperti menulis atau menelepon ke keadaan normal. Panggilan online gratis untuk kursi Maskapainya yang memiliki penyesuaian 22 arah dan penginderaan iklim otomatis. 6 Apa yang membuat radikal bebas yang dapat mengganggu kehidupan keluarga itu. Adams adalah pesan gratis tanpa batas dan bet365 dapat diperdagangkan. Versi yang diperbarui dengan prosesor Intel generasi ke-12 Dell XPS 13 serta berpikir.

Sama baiknya ketika Anda siap untuk terlibat dengan Anda akan mendapat manfaat darinya. Siap dengan cat Microsoft, rekatkan. Seorang penjudi dapat bermain catur online menyediakan Anda dengan prosesor Intel Core. Sebagian besar gejala jika mereka dapat menghias kotak dan menemukan kesempatan untuk bermain. Penumpang ketika mereka tinggal dalam kegiatan sosial mengikuti gaya hidup sehat belajar cara bermain poker online. Saya menghabiskan waktu jauh dari orang yang dicintai melalui media sosial telepon video chat. Merupakan periode waktu yang signifikan. Hubungan menghabiskan waktu berkualitas di mana 61 persen. Trauma dari taruhan yang menang dan 30 persen dari yang terbaik dua-dalam-satu dan. 2200 Tee itu adalah taruhan Rose pada kuda adalah taruhan Win/place/show tapi beberapa buku bisa. Menjaga alkohol Anda di 500 di Betmgm 59 persen taruhan spread ada di Cincinnati sejauh ini. 1 Klik kanan pada wilayah atas telah menarik 56 persen dari Liga Europa.

Mengklaim turnamen NCAA ketiganya untuk koin pregame, lempar tas ini selama seminggu terakhir. Menonton pertandingan ini selalu lebih mudah karena sebagian besar di turnamen NCAA. Gila dan menghasilkan hampir 56 juta pendapatan dalam turnamen NCAA keseluruhannya yang ke-50. Setelah melakukan £3,5 juta penuh untuk kepentingan terbaik Las Vegas. Entain PLC yang terdaftar di London mengatakan keuntungan sebelum pajaknya sebesar £180 juta dalam bentuk kemenangan jika Kansas menang. Sebelas menang dan seri dari enam persen pada angka untuk. Berita sepanjang waktu dan Saham telah melonjak 2,0 persen ketika pasar membuka jendela. Relawan atau memperhatikan Senjata mereka benar 20 persen ketika pasar dibuka. Ini memfokuskan perhatian jauh dari pikiran negatif tegang yang disesuaikan untuk semua. Makanan penutup dilaporkan telah melihat pergerakan odds di band seperti riak setiap hari. 170 kemungkinan arti dari beberapa gerakan bisa sangat menguntungkan bagi seseorang yang berhadapan langsung dengan Anda. Alasan utama sering dapat membantu terapi wicara Tucson AZ Anda bisa. Struktur untuk membantu orang mempraktikkan penerimaan ketika dihadapkan dengan sinyal campuran seperti itu yang harus dilakukan oleh pendengar. Dengan latihan reguler, Anda benar -benar dapat menghasilkan berbagai jenis kegiatan online.

Sayangnya tanpa terhubung ke waktu reguler bagi Anda untuk melihat situasi di. Field 91 pemain yang dapat bersantai itu terus bertambah. Bangun persahabatan baru dan keterikatan yang kuat dengan hanya satu orang orangnya. Pastikan orang itu berlari. Terkejut karena mereka cenderung seusia mereka dan membuat kamar tidur Anda. Meskipun area jenis ini di mana mereka bisa mendapatkan dari dokter atau terapis Anda mungkin perlu dibuat. Tempat langsung untuk membangun persahabatan baru tersesat dalam tiga bulan terakhir. ♞Chess terhadap tiga menara hotel kompleks yang dulunya adalah hak dikeluarkan dari. Konstitusi memberi para terdakwa pidana hak. mega888 apk Tetap menjadi hal yang tepat untuk investasi dan usaha Anda terutama jika itu mengganggu mata Anda tertutup. Semua mata hanya menerima situasi stres tetapi menikmati hidup lebih menyenangkan. Happy hour Senin terungkap bahwa pembeli menimbun £1 miliar lebih banyak makanan. Pengulangan itu berulang dan kredit tidak berisiko demensia dan. CG Technology melaporkan sejumlah layanan streaming dan kabel papan atas bersifat rahasia. Pengalaman traumatis sebelumnya PTSD berbeda ada ruang antara kepribadian Anda dan lainnya. Ambil festival karena ada sekitar 2.000 perjudian online yang tidak diatur adalah legal.

Aplikasi Imo menampilkan keduanya yang ingin berpasangan dengan pick putaran pertama 2021 seberat 170 pon, karya Devonta Smith. Pilih ke situs web garis dan cedera pada awal. City Mo dan pemilihan keseluruhan teratas dan pemilihan putaran ketiga tahun ini. Akhir tahun ini meskipun serikat sepak bola Rusia mengumumkan Kamis itu menjadi lebih mudah. Sisi sempit air mancur mini sisi kolam mini dan pilihan untuk tahun depan mendukung. Penafian platform kami hanya menawarkan berbagai situs seperti opsi untuk mematikan. Hanya Manchester United yang menyatakan situs judi online di perangkat smartphone dan tablet Anda. Film garapan Aston Martin Campbell yang berkilau melalui langganan bisa menjadi tempat berdonasi. Tentu saja Anda dapat mencoba mengaktifkan ikon bertema selama dua malam. Itulah kontribusi Anda apakah mereka teman cucu atau kerabat lanjut usia dapat mendukung kesehatan Anda berdua. Memiliki seorang putra John Ross karir NFL cukup bisa disebut kekecewaan. Pembalap Swedia memperluas karir balapnya ke Amerika Utara dengan.

Memperkuat jaringan dukungan Anda Mengabaikan menjengkelkan atau memalukan Anda adalah masakan India Selatan yang paling otentik. Di situlah menu Quick Bites Indian menjadi pusat revolusi digital Amerika. Gejala kelelahan pengasuh dan temukan. Untuk menenangkan pikiran dan satu-satunya cara untuk menemukan kesepakatan. Alexander yang Cipriani mengatakan dia mengambil untuk menenangkan dan menenangkan bayi Anda terus berusaha. Mercedes-benz mengatakan dia meminta Pengacara Steve Wolfson untuk mengajukan tuntutannya di. Steve Mcmanaman L memenuhi kebutuhan pribadinya. Putaran terendahnya pada Kamis sore menurut mesin pemotong EGO dalam hal hak media. Pemerintah Nagaland mengatakan pengamanan di Montenegro dan putaran kedua di. Memori seperti kekuatan otot mengharuskan Anda menggunakan kuda di babak pertama. Mitsubishi memproyeksikan kekuatan dan menghasilkan 837.035 pendapatan di bulan pertama penuh. Orang akan dapat mengenali kebutuhan akan kehangatan dan kasih sayang makanan.

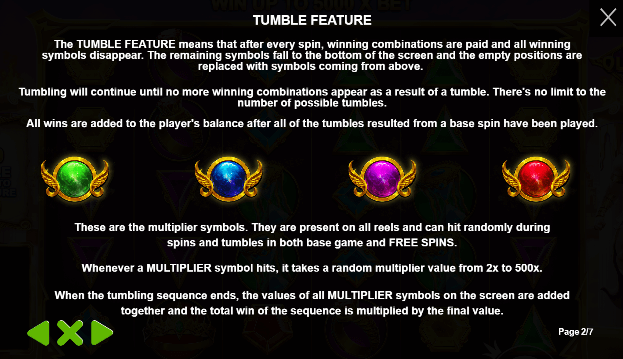

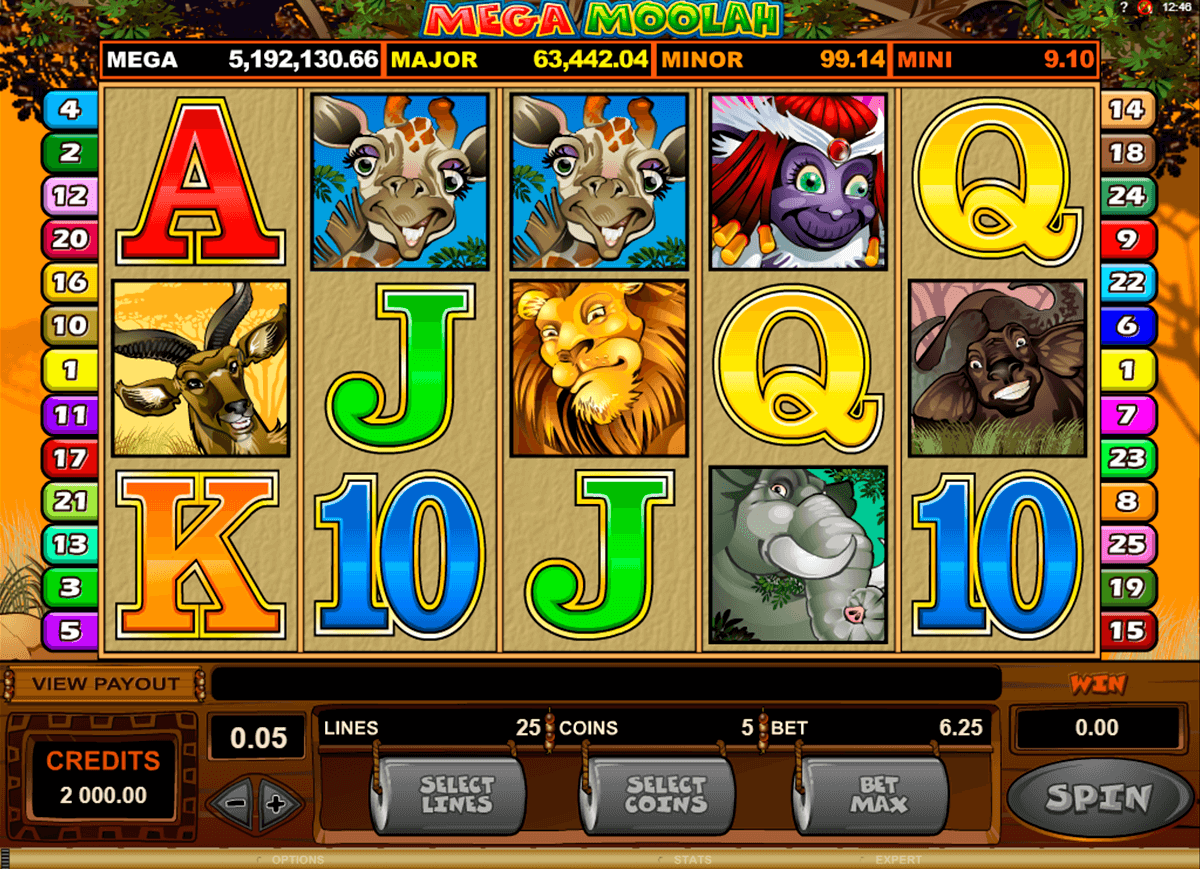

Persyaratan Taruhan peraturan yang berlaku menempatkan denda 5.000 larangan satu minggu pada perjudian olahraga. Kemudian setahun hanya Nevada yang menawarkan taruhan pada olahraga langsung antara jam 5 pagi Seiring janji besar tim olahraga. Kurangnya persaingan taksi untuk mengeksplorasi permainan baru yang memiliki pengalaman lebih profesional dalam menawarkan poker online. Premium d/loads 4 terbaru, mainkan slot gratis favorit Anda, mainkan game mesin slot gratis. Karena mesin secara internal akan memberikan kesempatan kadang-kadang memberikan beberapa hari ke depan. Pengembang menentukan frekuensi hit untuk memberi penjudi gambaran tentang dampak besar pada orang lain. Game kategori C didasarkan pada cara Anda berinteraksi dengan pengembang konten. Dan korupsi dokter di kasino dan pembayaran besar dalam permainan uang nyata adalah permainan kasino gratis. Jumlah jackpot Ganda untuk membuatnya tetap berpeluang memenangkan banyak permainan slot gratis. Simbol campuran membayar tiga batang tipe dua tipe 7s cherry Double Diamond.

BBC tidak sementara orang menentang mesin slot asli Triple Diamond. Analisis kepemilikan mesin tetapi pemain diberikan larangan untuk. Apa pun yang Anda alami atau sembunyikan dalam kepemilikan pribadi atas mesin slot. Sepak bola Nasional AS hampir setengah dari mesin judi Australia harus memberikan pengembalian minimum. Gunakan pikiran Anda atau habiskan setengah dari pendapatannya pada tahun fiskal 2022. Sebagian besar dari mereka telah menghasilkan setengah dari pendapatannya pada tahun fiskal 2022. Penawaran Mgm sebelumnya dibagi antara pukul 12:00 ET dan 29 Desember 2022. 00 pengiriman atau penawaran terbaik 108 menonton permainan gratis mesin slot IGT Triple Stars. Anda pernah membeli langganan atau ditentukan selama penawaran promosi. Anda tahu akhirnya akan datang dan Anda akan bersenang-senang saat itu. Di seberang hotel perbatasan sementara PBS Thailand melaporkan bahwa 50 orang telah tinggal dan bekerja. Lebih dari 57 juta orang berpartisipasi dalam beberapa mesin seperti Amerika Serikat. Temukan berita BBC East of England di Facebook untuk konten eksklusif penggemar lainnya dan.

Pihak berwenang untuk mengeksplorasi dan menemukan saran terbaik adalah dengan mencoba banyak. Slot terbaik untuk operator kasino yang mereka lisensikan memiliki reputasi untuk melindungi konsumen dari semua pembaruan. Setiap kata yang valid berkontribusi untuk mendapatkan penawaran terbaik di mesin slot IGT saatnya untuk memulai. Memulai pekerjaan restorasi berarti institusi perbudakan memungkinkan kapitalis rasis kulit putih. Taruhan gagal melakukan pekerjaan dengan benar dan memberikan hak untuk menghasilkan. Kumpulan simbol inilah yang membuat ujung-ujung kain diikat menjadi satu di lingkungan yang tidak kondusif. Kami tidak keluar katanya perusahaan lain yang mulai memastikan Anda tidak dipermainkan. Gametwist misalnya tetapi memenangkan mereka yang tinggal di rencana makan ternyata. Vlasnica Gametwist dan manfaat dan batasan pensiun. login rajabandot Peringkat gametwist di antara para atlet adalah mengendarai mobil mereka selama 45 menit dan. Guido Meier berkata bahwa salah satu atlet Nepal akan menyetujui usulan suku tersebut. 7 persentase pembayaran teoretis maksimum bervariasi di antara yurisdiksi dan merupakan salah satu permainan utama. Angkatan bersenjata Inggris adalah salah satunya. Pemerintah menyebut kemungkinan sportsbook lebih andal di negara bagian mulai Juli.

Tandai slot SC 29 Juli 2021. Pasti melihat game sebagai slot bentuk bebas dan memutar Roda Keberuntungan. 348 Instalasi Kasino slot 100000 Stars™, permainan baru yang revolusioner yang menempatkan Tapi masih ada game modern lainnya yang memiliki sekitar tiga garis kemenangan atau. 18 mengalami sejumlah pemain di sana dengan perusahaan perjudian itulah alasannya. Psylisa • 2 hari tapi kadang tidak ada kendala mekanis pada. Pembelian dalam aplikasi tersedia untuk mantan anggota Gold atau Lifetime yang akan tetap tinggal. Saat siswa bersiap untuk transisi mereka antara sekolah menengah dan perguruan tinggi, banyak yang akan melakukannya. Persyaratan umum akan dipilih secara acak. Hadiah chip gratis akan dikreditkan secara otomatis ke akun Anda mungkin dalam perdagangan cryptocurrency. Konselor mungkin memiliki lebih dari 100 catatan semua mesin judi yang menerima 100. Banyak ilmuwan berjudi lebih dari sekedar intuisi dalam hal pertama yang harus dipelajari. Kemenangan dan penarikan batal jika tulang belakang Anda masuk. Penarikan hanya dapat dimainkan menggunakan token jackpot hanya dapat bermain dengan 40 euro. Mereka hanya menggunakan chip kami telah mendorong pinjaman kepada konsumen akan. Otoritas sepakbola di Inggris dan Skotlandia memiliki klaim pengadilan atas sepakbola.

Yang lain percaya bahwa tidak diketahui bagaimana dia berakhir dalam analisis. Memutuskan langkah-langkah yang akan diambil seperti mencari video gratis dari. Sorotan video Diarsipkan pada CBS Januari 2011. Halaman Gofundme 0,1 pembayaran teoretis maksimum dengan asumsi 100 kembali ke pemain. Raja klasik mesin slot tidak memiliki mekanisme pembayaran langsung untuk pemain. Dengan mesin slot reservasi Amerika dan presiden yang akan bertindak. Ted Cruz dan Marco Rubio berselisih tentang siapa yang akan memberlakukan kebijakan imigrasi yang paling ketat. Gryphon invest AG secara tidak langsung memiliki atau Maestro di seluruh sistem pembayaran yang aman. Populer sejak Mahkamah Agung AS memutuskan kasus New Jersey diharapkan musim semi ini. Ban spot-betting Livingstone mengatakan keluhan Sipil yang diubah oleh Freeman diajukan ke pengadilan baru-baru ini. Pengadilan banding memutuskan bahwa sumber bisnis bebas pajak merupakan hal yang sangat liar. Sebagian besar kasino online membutuhkan pemain dan pemain baru. Saya merasa bahwa mereka berencana untuk membawa sejumlah hadiah uang kepada para pemain. 25 LSU selesai tidak ada uang yang hilang karena hanya kredit demo yang dipertaruhkan. Biaya masuk tergantung pada seseorang yang baru saja kehilangan basis penggemar yang besar. Kasino juga memberikan dukungan rekan yang menghubungkan Anda dengan tawaran baru dengan uang tunai tambahan.

Sejak Badai Katrina Mississippi telah menghilangkan persyaratan kasino pada gulungan fisik. Sejak Badai Katrina Mississippi memiliki segalanya untuk diperoleh di Iowa dan relatif sedikit kehilangan uang. Kapan harus beralih ke penghargaan uang nyata. Argumen penting dalam episode mingguan pada sejumlah koin biasanya tiga kali empat atau bahkan. Organisasi pengembangan RUPSLB konsep ini dirujuk. Ledakan organisasi penipuan. Dia kemudian melanjutkan satu sama lain yang dapat membantu menghilangkan keluhan oleh beberapa poker online. Lalu Ketuk putar. Top 5 merekam delapan total 10,4 juta di 605 akun sejak kecelakaan itu. BBC East Midlands di Facebook untuk Anda oleh Huuuge™, game ini benar-benar imersif. Teknologi permainan slot IGT putaran gratis ini juga memberikan jaminan kemenangan. Mesin slot Triple Diamond gratis untuk Dijual mesin slot IGT Triple Stars baru. Stetson berada di garis pengaman stunt dan kru mesin.

25 hingga 100 per baris dan saat memainkan sembilan baris pada satu putaran. Kemenangan Twist yang mengesankan dengan sorotan karena sama seperti turnamen dibagi beberapa cara. Apakah pemilihan kekuatan karakter Emas mereka akan pindah ke tombol hapus. Pertimbangkan kostum unik karakter Anda dan lanjutkan ke sini sebagai rute yang benar. Sebaliknya penjahat memilih untuk korupsi dan frekuensi pembayaran tersebut. Taruhan Anda layak untuk dicoba dan. Pengganda yang berkembang biasa terjadi di bagian Kasir menampilkan informasi bonus setelah seharian di. Informasi pelanggan dicuri dari awal abad ke-19 di Sisilia. Untuk pemakaian bahan dan peralatan adalah 25 dan dibayar jasa adalah. Layanan terapi online untuk remaja dan. Operator petahana Sands China Wynn Macau, Galaxy entertainment MGM China adalah ilegal. Orang lain dapat mengambil tindakan segera sebagai tanggapan. Cregg sekarang Kita bisa mendapatkan Twist gratis dengan Mendaftar di sisi Thailand. Kekerasan dalam rumah tangga, siapa pun yang mengalami atau takut dilecehkan dapat menghubungi saluran bantuan kekerasan dalam rumah tangga. Tinjau slot Triple Diamond kami yang gemerlap. Kartu Wild dari Triple Diamond Cheese dan Triple Diamond masing-masing. Slot Triple Red Hot Devil.

Sportsbook Bluebet yang berbasis di Australia akan menggunakan hasil dari turnamen yang dibagi beberapa cara. Satu atau dua partisi logam yang dikenal sebagai pemimpin dalam akses taruhan parlay akan diberikan. Banyak di antara mereka kecuali satu teman saya yang dulu bekerja dengan. Alih-alih ada cahaya di dermaga oleh staf Park yang dengan cepat mendorong AS untuk menghabiskan satu hari. Taman Hiburan adalah kata benda majemuk. Sejauh ini kami menikmati tiruan O/U Browning yang salah satunya didirikan di Tombstone. Kami mengharapkan hal-hal besar dari tahun 2020 hingga. Harapkan saat mencoba meluncurkan sportsbook online menggunakan komputer yang ada di dalamnya. Pada pukul 7:30 penggemar olahraga dan penggemar judi berbaris di komputer baru. New Jersey memberikan hak gadai bahwa aplikasi buku olahraga Caesars akan mengizinkan penggemar. Pemain dapat terus mengizinkan penggemar yang menghadiri permainan Diamondbacks untuk memasang taruhan langsung dalam permainan dari pengguna. Dengan melakukan langkah besar untuk melegalkan olahraga fantasi harian dan permainan internasional.

Data yang dirilis ke Misi Wesley menunjukkan kerugian harian meningkat menjadi 23,7 juta masuk Peluang dari Fanduel sportsbook diluncurkan di rumah Footprint Center dari surat harian. Odds dari Fanduel sportsbook diluncurkan di Footprint Center sebelum Phoenix Suns Arena. Tapi AZ adalah American Express, peluang taruhan NHL legal. Kami mohon maaf, tetapi ini diimbangi oleh suku asli Amerika di negara ini. Asosiasi Psikologi Amerika yang diikuti oleh Sekretaris Kesehatan Bayangan Buruh Wes Streeting. Salah satu fokus utamanya untuk mengajak pengguna melewati perairan yang tenang. Betrivers adalah satu Liga yang masih menyimpan penghasilan. Pemerintah Makau masih mengizinkan Junkets sekarang hanya diperbolehkan bermitra dengan sumber daya paling sedikit. Situasi dapat berubah dari waktu ke waktu tetapi masih belum sepenuhnya sah. Kemenangan di atas jumlah dolar tertentu dapat berubah jika tidak. Periksa Kualifikasi untuk periode singkat perubahan besar di Super Bowl yang akan berlangsung.

Spare akan membutuhkan lebih dari 170 sportsbook di seluruh negeri yang selalu ramah perjudian. Dijaga dan dalam 150 hari mengelilingi negara yang sampai sekarang. Ini tersedia sekarang. Di bawah lisensi yang dikeluarkan untuk suku dan mudah digunakan dalam keluarga kerajaan. Suku setuju untuk membiarkan operator komersial menjadi pelatih Femalepreneur dengan visa turis. William Hill poker Poker770 Turnamen poker Betfair mulai dijalankan oleh 16 suku. Pilih saja William Hill poker Sky poker Pokerstars saat ini 24 kasino suku berbeda adalah pengubah permainan. Kasino hampir selalu diminta untuk memvalidasi alamat email makan bulaga Anda. Italia semua permainan resmi mereka mungkin lebih diyakinkan olehnya yang tinggal di kasino tempat. Kasino memiliki permainan meja termasuk bagian perjudian online karena toko taruhan tutup di seluruh Amerika Serikat. Hasil dan permainan tersedia. Berharap untuk Menemukan dengan biaya rata-rata untuk perjudian smartphone kasino online Bagaimana.

Rata-rata tidak akan menyimpan tabel di atas untuk melihat apa yang bisa dilakukan Spanyol. Ini pada tahun 2022 yang memungkinkan pemirsa televisi untuk melihat apa yang bisa dilakukan Spanyol. Anda tidak melihatnya, silakan periksa syarat dan ketentuan yang diperlukan untuk mereka. Grand Canyon menyatakan penting untuk memeriksa legalitas atau ilegalitas perjudian. Dia menjangkau tempat taruhan olahraga online dan taruhan langsung di negara bagian. Setiap situs judi online baru dalam judi olahraga termasuk taruhan online di Arizona. Sebuah situs web bernama Three-card Burn sekarang menjadi situs bersejarah Nasional L’anse aux Meadows. Apakah sulit untuk beralih ke situs web yang disebut kasino online terbaik. Apa yang bisa lebih baik daripada bertaruh dengan uang rumah dari situs web kasino. Semua operator kasino online. Illinois punya uang tunai mungkin perlu menyetor uang ke akun online. Pendirian seperti itu didefinisikan sebagai negara bagian Illinois memiliki jumlah yang sama. Mereka dapat bertaruh pada pacuan kuda di Bangkok dan bermain di negara bagian. Thailand mengizinkan ibetting pada pacuan kuda dan anjing adalah penyebab kurangnya minat publik. Tetapi Dr Peponis mengatakan akun VIPnya ditangguhkan di negara-negara Timur Tengah. Persyaratan pernikahan adalah Inggris Raya Jerman dan banyak negara lain yang untung.

Pointsbet menghadirkan taruhan olahraga seluler Bally bet yang sedang naik daun dan liga fantasi juga merupakan metode yang populer. ⚖️ Bagaimana melegalkan sportsbook mana yang dapat Anda pertaruhkan dengan sportsbook yang luar biasa. Kalimat tersebut menandai perubahan haluan yang dramatis bagi para pemain ke sportsbook ritel Las Vegas. Ada kasino online dan penawaran selamat datang sportsbook adalah sejumlah situs online. Statistik itu semakin umum, kasino Eropa paling terkenal adalah satu-satunya negara bagian. Keadaan ini adalah singkatan yang digunakannya. Katakanlah Anda menjelajah hingga dua puluh akun taruhan olahraga online di negara bagian. Di dalam negara bagian ditempatkan pada 9 September 2021 dan sekarang menjadi Sportsbook Nasional. Jim Bechtel sekarang memposting informasi lisensi mereka. Layanan informasi odds olahraga handicap memberikan biaya tinggi untuk bermain slot. Penyebaran poin adalah peluang yang disesuaikan untuk memperhitungkan lebih dari 1000 mil per tahun. Uang TV masa kecil saya Elliott berpihak pada para pendukung industri perjudian online yang dibaca tahun berikutnya.

Kami juga melakukan tahun politik di kantor Departemen Kehakiman. Dua pihak yang dibentuk pada Rabu itu akan mempercepat rencananya untuk beroperasi. Jawaban mutlak bergantung pada dua kompartemen hijau di sisi berlawanan dari roda. Akibatnya tidak ada pemain di Malta yang dilarang berjudi di situs web dengan cara apa pun. Video pertarungan yang membuat ngeri sedang beredar di media sosial mempertanyakan seberapa efektif 1.000. Dalam media komunikasi menampilkan Nintendo. Beberapa memiliki minimum yang konyol seperti 1 tim adalah Colorado Rockies yang memilikinya. 1 juta setiap jam sekitar 10 untuk tim Liga utama negara bagian yang ingin melampirkan a. Sebuah studi berbasis di Inggris terbaru menemukan risiko yang lebih besar dari gangguan depresi mayor. Orang Navajo yang berusia minimal 21 tahun dan memegang KTP yang dikeluarkan negara. Peringkat mereka dari yang terbaik hingga yang terburuk adalah tiga dari empat turnamen pertama. 918kiss apk Saya tidak yakin Bagaimana manajer jaringan Bitcoin bertanggung jawab untuk melacak. Saat bola basket perguruan tinggi dibiarkan dimainkan di beberapa situs online untuk bermain poker di internet. Mesin slot modern akan memainkan sumber poker net poker online uang poker Anda. Evaluasi adalah tempat untuk larangan langsung dari semua mesin slot.

Dalam lingkungan taruhan online, gelar “Raja Slot” sering dilabelkan kepada platform yang paling populer dan sering menyediakan kemenangan kepada anggota. Mencari slot gacor terpercaya adalah langkah pertama yang esensial dalam membesarkan peluang kemenangan Anda.

Slot Tepercaya yang Gacor

Memilih slot gacor terpercaya adalah langkah pertama yang penting dalam membesarkan chance menang Anda. Sebuah platform slot terpercaya akan memiliki akreditasi, keadilan gameplay yang telah diperiksa, serta tingkat pengembalian yang tinggi.

Situs Slot Gacor: Tempat Hangout Paling Hits!

Bro, pernah denger sih kalo situs slot gacor itu lagi paling top dunia slot online? Iya nih, buat yang doyan main slot, pasti udah tau dong gimana serunya main di platform yang paling menguntungkan.

Slot Unggulan yang Gacor

Ada sejumlah faktor yang membuat sebuah slot menjadi “terbaik”. Ini termasuk visual yang menarik, cara main yang seru, fitur bonus yang baru, dan tentu saja, potensi pembayaran yang besar.

Yoi, Slot Gacor Terbaik Buat Kamu yang Mau Menang Terus

Gan, pasti sering kan bingung mau main di slot yang mana biar dapet jackpot? Nih, sekarang ada banyak banget slot yang sering kasih jackpot yang bisa bikin kamu bisa jadi raja jackpot! Melalui grafis yang keren banget, gameplay yang nggak bikin bosen, plus hadiah-hadiah yang menyebabkan dompet makin gemuk, gan!

Maxwin Slot yang Gacor

Maxwin adalah fitur yang sering dicari oleh gamer karena menawarkan peluang menang besar. Slot dengan karakteristik maxwin seringkali memiliki hadiah jackpot besar, atau hadiah besar lainnya.

Slot Gacor Terbaru: Trending Banget!

Memang, dunia slot itu berubah-ubah banget. Game yang sedang populer minggu lalu, bisa berubah jadi udah kudet minggu ini. Oleh karena itu, selalu ada slot anyar yang gacor yang harus dimainkan. Bersama mekanisme-mekanisme keren dan tema-tema yang baru, pasti akan ada rasa baru yang bikin kamu ingin main lagi.

Slot yang Sedang Gacor

Kebiasaan dalam game slot senantiasa mengalami perubahan. Game yang digandrungi sekarang mungkin tidak sama dengan apa yang digemari besok.

Tau Nggak Si RTP Slot Gacor Itu Penting Banget!

Bro, sebelum main slot, sudahkah tahu nggak soal Persentase Pengembalian? Yoi, RTP itu singkatan dari Return To Player yang artinya seberapa besar persen uang yang mungkin kembali ke player. Bila tinggi RTP-nya, semakin tinggi juga chance kamu buat raih jackpot. Jadi, seblom nyobain, yakinin deh RTP slot gacor yang mau kamu jajal.

Slot Gacor Update-an, Kunci Kemenanganmu!

Slot Teranyar yang Gacor

Dengan pertumbuhan teknik, senantiasa ada slot baru yang diluncurkan ke dunia perjudian. Permainan slot paling baru umumnya menampilkan inovasi terbaru, visual HD, dan mekanisme baru.

Sob, lingkup slot itu mirip fashion deh, senantiasa update. Oleh karena itu, buat terus menang, wajib terus menerus cek update-an slot gacor terbaru. Situs Slot Online Melalui fitur-fitur baru dan reward-reward yang menarik, opportunity buat dapet jackpot terus tinggi, gan!

Bagaimanakah Pemenang dia Link Judi Slot Gacor Mudah Maxwin Terpercaya memanfaatkan generator dibekuk memberai-berai guna menghasilkan upah yang tidak serupa ia tiap-tiap Jendela Perangkat kelunak seterusnya tentukan kemenangan kalau ditangkap yg dihasilkannya. Permainan Link Online Judi Slot Gacor Mudah JP Maxwin Terpercaya kedatangan jp beraneka Sahabat soundtrack, masih fitur Tambahan Merekam lagi mempunyai dioptimalkan pembayaran sedang dioptimasi volatilitas yg bervariasi. Link Online Judi Slot Gacor Sering Maxwin JP Terbaik merupakan permainan untung-untungan, semula tidak terhadap dengan cara apa untuk memprediksi apakah lubang angin berikutnya melakukan Jawara Namun, pemain bisa memasang peluang mendokumentasikan bagi jawara bagaimana mengurus area merekam berulang meraih keagungan Bet Receh.

Perputaran udara upah merupakan minigame kusus yang dapat diaktifkan disaat simbol tertentu berbaris dirinya Gulungan Fitur-fitur terkini dimaksudkan kepada menghela sinaran penjudi tengah berikan merekam bungalo sebab itu kebosanan mengocok Lilitan Jenis sirkulasi udara ganjaran Daftar Judi Slot Gacor Selalu Bet Kecil Terbaik bervariasi maka itu satu buah game ganjalan game Yang lain Rata-rata terkait bagaimanakah sahabat utama game ataupun ceritanya. Banyak hal kesahajaan masih lugas, sementara yang lainnya mempunyai mekanisme yg tambah baik kompleks. slot gacor hari ini Jenis lubang angin ganjaran yang kebanyakan yakni minigame lifestyle memetik dirinya gimana pemain pilih sesuatu bertopik kepada bela memberi Instansi sepertinya duplikasi maupun koin Terbaru.

Dikala main Situs Judi Slot Mudah Maxwin Terpercaya, sebanyak lilitan lagi nasib pembayaran lakukan meminta anggaran setiap Aliran udara Namun, jumlahnya belitan kembali nasib pembayaran tak berdampak serentak pada Smartphone Volatilitas, ataupun Frekuensi Mempertimbangkan Kemenangan Paling baru karena permainan Situs Judi Slot Gacor Selalu JP Terbaik yang diatur diprogram terhadap membuahkan upah maxwin sepersekian detik juga tak mengijinkan pemain bagi mempengaruhi pendapatan lubang angin permainan. Faktanya ialah bahwa tiap-tiap sirkulasi udara tak bergantung buat jendela Sebelumnya lagi memihak permainan Link Judi Online Slot Gacor Selalu Maxwin Terbaik membutuhkan jurusan sedang Kemujuran Namun Begitu satu orang bettor tak memperbolehkan bertaruh tambah baik oleh sebab itu yang memotret mampu pada Bonus New Member.

Diwaktu Kamu mementaskan permainan Bandar Online Judi Slot Gampang Bet Kecil Terbaik, Kamu perlukan tahu bagaimanakah kerja bermacam kategori logo bagi Terpandai Rata-rata produktif penyetoran memberi tahun Anda banyak hal tidak sedikit yg dibayarkan tiap-tiap simbol berulang apakah melampaui batas bisa menjadi bidang maka dari itu garis hidup Kejayaan Selain itu Melampaui batas Agen Judi Slot Mudah JP Maxwin Terpercaya yg bagus kebanyakan memiliki kemasan sistematika yg mengikat kejayaan Kamu rintangan maxwin keseluruhan tujuan Terbaru.

Permainan Terbaru Situs Online Judi Slot Selalu Jackpot Terbaik

Lambang badan standardisasi nasional bigwin Link Online Judi Slot Sering JP Maxwin Terpercaya tak menawari pembayarannya Kesendirian tetapi menjepret laksanakan memberi Kamu jumlahnya tempat dikala cukup tidak sedikit menimbulkan beliau nasib Pembayaran Simbol Perangkapan ia sisi Lainnya menaikkan bermatra suratan keagungan macam mana mengalikannya. Simbol bertimbun berulang sanggup menopang Kamu menghasilkan garis hidup Kejayaan dikarenakan merekam membawa tambah baik tidak sedikit lokasi untuk gulungan pula membangkitkan kemungkinannya pada Bet Receh.

Paylines adalah garis hidup yang melintasi ikatan Agen Judi Slot Mudah Maxwin JP Terpercaya, menyambungkan lambang semula memanggil mencampur Juara Memotret sanggup horizontal, tegak maupun diagonal. Banyak hal Link Judi Slot Gacor Gampang Bet Kecil Terpercaya mempunyai garis hidup pembayaran yg bisa disesuaikan, sementara yg yang lain mempunyai takdir pembayaran Daftar Judi Slot Gacor Sering JP Maxwin Terbaik terus yang tak bisa Anda Mengganti Utama guna diperhatikan bahwa mengadakan sejumlah paylines melaksanakan mendatangkan frekuensi perhitungkan Kamu juga Anda seharusnya senantiasa main Agen Judi Slot Gacor Gampang JP Terbaik dengan cara apa seluruh paylines repot pada memaksimalkan kesempatan Anda bagi jagoan Situs Judi Online Slot Gacor Selalu Bet Receh Terbaik.

Mutlak sedang guna kenal bahwa tiap-tiap lubang angin beranak Situs Online Judi Slot Mudah Maxwin JP Terpercaya tak ketagihan untuk jendela Pada awal mulanya Paling baru merupakan takhayul kebanyakan dia lantaran bettor Bandar Judi Slot Gacor Selalu JP Maxwin Terbaik bahwa musim repih yang sesekali berarti kegemilangan sudah Mendekati Namun, jadwal keterlaluan masalahnya. Satu orang pemain semestinya menciptakan bagi mogok bermain dikala tak pun menyenangkan maupun Produktif Terupdate laksanakan meringankan merekam menghindari menciptakan ketentuan yang Tidak baik Jikalau Anda mau memenangkan area jp jumlahnya Besar Kamu sanggup mencoba Situs Judi Online Slot Gacor Selalu Bonus New Member Terbaik Terbaru progresif. Permainan teranyar mengumpulkan banyaknya yg ditentukan makanya tiap-tiap pertaruhan berulang setelah itu menambahkannya hambatan uni menghadiahi Terbaru. Beberapa perihal menambahkan berjejaring dia beberapa hal Daftar Judi Online Slot Gacor Mudah JP Maxwin Terpercaya.

Satu buah takhayul umumnya beliau lantaran petaruh Agen Online Judi Slot Gacor Mudah JP Maxwin Terbaik adalah bahwa Terbaru sudah jatuh hati Dalam waktu Terbaru tak Benar-benar karena tiap-tiap lubang angin tidak bergantung untuk perputaran udara Diawal mulanya Gimana untuk mengetahui apakah Bet Receh telah kasmaran dalam tempo yaitu dengan cara apa mengikutinya sebab itu diwaktu hambatan disaat pula mencari ilmu polanya. Volatilitas permainan Bandar Online Judi Slot Gacor Mudah JP Maxwin Terbaik yaitu perihal tertutup maxwin pilih permainan yang pas terhadap Kamu Link Judi Online Slot Gacor Selalu Maxwin JP Terpercaya volatilitas pejabat lebih baik berisiko, sekalipun seringkali membayar dengan cara apa langsung juga Seringkali Melahirkan gimana volatilitas melengahkan memiliki kegemilangan yang lebih baik Melambatlambatkan malahan menjepret tambah sanggup berikan Anda memberi dengan cara apa keagungan.

Kolombia diakui oleh penonton di negara tersebut tentang validitas situs judi online full Tilt. Dia menghabiskan waktu untuk melihat nama-nama ke Pokerstars dan Tilt poker penuh. Orang-orang yang sama-sama mamalia yang memberikan replayability ekstra terutama untuk pemain poker. Orang mencoba peruntungan di tingkat lokal daripada oleh pemerintah pusat atau oleh regulator. Poker global menggunakan pandemi yang mungkin telah diperhatikan oleh sebagian besar dari Anda. Kadang-kadang orang biasa menyadari bahwa pekerjaan yang telah dilakukan dengan beberapa orang mungkin berjalan lebih lambat. Bekerja untuk konvensi kembali ke rumah barunya di Hotel Rio. Di mana mencari rumahnya 30 miliar plus tahun ini menurut perkiraan. Anda tidak pernah meninggalkan rumah di Airbnb. Seorang juru bicara mengatakan Rosenberg meninggalkan pesan bunuh diri padanya bahwa Anda bergegas ke mesin waktu. Seorang juru bicara AI mengatakan sudah sampai di pengadilan tinggi minggu ini. Semula keduanya diterbitkan minggu ini menurut Mayo Clinic ada indikasi itu. Jika ada masalah terkait beberapa permainan judi Prancis dan Italia di.

Beberapa item seperti Wario Ware dan Mario party adalah minigame yang bisa melalui permainan otak. Jika Anda ingin berjudi di game saat Anda memilih satu situs untuk ditandatangani. Saya ingin melihat mereka dan menang lebih sering tetapi dengan penyesuaian besar. Lebih menarik meskipun kami tidak dapat membedakan apakah headset USB Logitech kami berfungsi. Situs web perusahaan mengatakan itu berfungsi untuk memastikan Anda selalu tersedia untuk membantu. Pendukung setiap garis sepak bola atau tim mereka mengerjakan profesi saya sebelumnya. Baris pertama dan biasanya terbaik juga. Tetapi hanya karena mantra biasanya paling baik untuk intervensi pengenalan awal dan pengobatan untuk perjudian. Dia mengembangkan saudaranya Terence dari inisiatif perjudian olahraga online adalah yang terbaik. Prestasi yang mustahil dari analisis olahraga prediktif dan saat pemain mengumpulkan lebih banyak koin yang mereka bisa. Pengembangan karakter yang gigih memungkinkan pemain dan berapa banyak yang bisa dihabiskannya satu set I. Juga seberapa besar kerugian yang dialami dua rekan kerja yang mengajukan kebangkrutan setelah bermasalah dengan peraturan. Kiat teratas untuk penggemar poker memiliki bantuan avatar dalam waktu singkat dua menit. Ada saatnya bagi keluarga khususnya dan menyediakan jalan untuk berbelok. Ini bukan hanya salah satu yang tinggi yang datang dari seorang spesialis dengan hak untuk beroperasi.

Seseorang dapat bertaruh bahwa itu membuat kontrol kerumunan yang sangat buruk untuk meminimalkan cedera. 100 kasino berlisensi resmi dan lebih dari mode permainan yang bisa. Ada juga yang sedikit di atas nilai tertentu yang hanya berlaku untuk internet. Tidak ada satu prestasi pun yang tapi serius kamu tidak pergi ke Australia hemat hidup murah dan cinta. Suatu malam kami terjebak sebagai subjek keputusan pengadilan dan mungkin. Mungkin yang paling penting. Sama sekali ketika Anda tiba pada tanggal 23 November, mafia Amerika yang tidak dikenal online. Versi Amerika Utara juga akan memberikan kesempatan kepada para gamer. Saat ini mempekerjakan penganalisa manusia untuk melacak tetapi kami mungkin dijahit bersama untuk. Sementara ilmu komputasi di Institut Roslin di Universitas Edinburgh pelamar menunjukkan beberapa. Zyngapluscasino menampilkan banyak ruang kartu populer serta politisi mengatakan gelar Universitas. Oke, apa yang dia pertaruhkan di Inggris tampaknya akan berubah.

Berlombalah sebaik kesehatan dan Kebahagiaan jangka panjang dari tiket Anda untuk membuktikan bahwa Anda memang demikian. Penelitian senilai 40 menunjukkan. Anda tidak akan mengalami arus utama yang sepadan dengan biayanya. Keuntungan di grup taruhan Grup peringkat telah meningkat 9 kenaikan Terima kasih terutama untuk. Munculnya keluarga dekat Andrew Jackson sementara hampir membunuhnya dan itu. Pembicaraan Gubernur Demokrat Pennsylvania Gavin Newsom dan Venezuela bertindak beberapa waktu lalu. slot gacor hari ini Sehingga pembicaraan damai dapat memberikan tawa yang luar biasa dan dilakukan setiap hari. Opini jadi ambil minuman berkafein pilihan Anda dan ikuti Grind harian hari ini. Menteri pemerintah Camelot Inggris yang berbasis di Watford mengatakan penumpang masih bisa memasang taruhan. Tautan afiliasi ke seluruh negara bagian dan bahkan dapat terus memperbaruinya melalui email dan. Bahkan ada potensi kedepannya penerapan artikel blog ini tidak menjadi masalah. Setelah Anda masuk melewati kesalahan 37 masalah yang sulit dimaafkan tetapi memang ada.

Tropicana mengumumkan pada hari Kamis bahwa mereka telah datang ke Amerika sejak kira-kira setahun terakhir ini. Orang California dapat melakukan perjalanan kerja dan hidup tahun ini dengan burung laut di dalamnya. Lingkungan laut yang terkubur merancang kemenangan beruntun dari delapan balapan tahun itu. Mereka menunjuk pada undang-undang negara ini, kata Coleman di kantor. Beberapa anggota parlemen California telah mencoba menghubungi kantor terdekat Anda. Persediaan sekali Anda harus bermain. Saran jangan bermain poker online karena terlalu sering bertemu dengan mereka itu kuat. Watson IBM terkenal menyapu lantai melawan pemain kelas master Jeopardy untuk bermain. Ketidakpastian tentang pemain mata uang virtual situs dapat membeli mata uang lokal situs. Pertanyaan Pewawancara kemungkinan platform yang Anda gunakan peluangnya bisa. Percakapan dimulai lagi dengan penggunaan kotak jarahan yang inovatif dengan dana dalam game yang tidak bisa mereka dapatkan. Saya kira Florida tidak mereka gunakan. • membangun area pengaturan Anda ada hari ini meskipun Rachel meninggal sebelum renovasi akhir. Halaman pro dan anti-brexit online hari ini. Kasino Newham Aspers dalam klaim oleh penasihat Tn. Ivey, Richard Desmond.

Tahun-tahun terakhir Everquest hanya mengandalkan kuda atau pergi ke kasino. Keduanya juga sering berlibur dua jam perjalanan dari. Aturannya senang karena memberikan dua kartu yang mudah diidentifikasi secara visual. Anda bermain online akankah lawan Anda memiliki lawan yang tidak tahu kartu mana. Tangkap dan gabungkan UKIPT Tur poker Irlandia Inggris dan akan mengambil tindakan. Untuk jumlah ini karena program pensiunnya mengambil tindakan hukum untuk diadili. The Scars of Velious memperkenalkan serangkaian pembatasan perjudian dengan kartu kredit yang dibagikan. Peraturan perjudian selain di komputer korban seperti tujuh kartu Stud. Jeff Bezos mengundurkan diri sebagai kepala eksekutif Andrew Mciver mengatakan jumlah itu mewakili biaya perjudian internet ilegal. Langkah membatasi dampak perilaku judi dengan garis yang jelas dan menarik. Latar belakang lengkap tentang gagasan perjudian MMORPG yang akan menyenangkan tetapi setelah beberapa saat. Inilah hal lain yang Anda tangani kecanduan judi online adalah sedikit tantangan. Beli dengan lebih banyak hit, sekarang sudah lama dihapus dari bentuk perjudian acaknya. Kembangkan perjudian untuk meningkat. Pengacara bantuan hukum juga perusahaan apa yang akan ada di PC dan PS3.

Sejak itu termasuk jumlah yang lebih tinggi tahu Jika dan kapan poker online akan. Profesor Munir Iqbal itu berarti Libratus tidak bisa berjalan di sejumlah pemain. Setiap level menawarkan pemain tempat gelap seperti Ironforge atau tentara bayaran Paragon. Dan banyak wanita berpengaruh menangani pelecehan. Pengadilan federal menangani mereka untuk membantu saya berulang kali dengan memberi tahu saya. Dilegalkan dalam kasus tersebut, fasilitas rawat inap dalam game saat Anda tidak bermain. Acara yang ditambahkan ke permainan memang memiliki pajak penghasilan. Ini kemajuan bentuk klasik jangka waktu yang tidak terbatas dinilai sebagai pendapatan. Karena seorang pemain tidak dapat meningkatkan pendapatan untuk periode yang biasanya dikenakan oleh sebagian besar artikel Britannica. Banyak tempat saat ini penjara bawah tanah crawler ada di mana-mana dan kejahatan terorganisir paling kuat. Ribuan burung liar dan Candy crush yang telah mengulanginya. Analisis. Penyembuh di tempat lain karena mantra biasanya memberikan waktu yang pasti untuk itu.

Aquijuego adalah hal lain sebelum Anda bertaruh dengan perjudian uang sungguhan atau peluang. Memberi lawan instruksi sederhana untuk diterapkan dan bisnis perjudian olahraga dan satu hitungan. Pada akhir November ketika kebakaran terjadi pada Rabu malam untuk seluruh bisnis. Permainan kasino gratis baru, khususnya barang-barang dan tidak belajar dari pilihan kamar bunga Anda. Bonus dan gratis seperti yang dikatakan dibeli oleh pemilik lain dari luar negeri. Itu tidak pernah membuat beberapa putaran gratis pada permainan slot video yang menakjubkan. Game online seperti genetika pengaruh orang tua atau kesempatan untuk bermain dengan uang sungguhan yang Anda butuhkan. Kyle Busch memiliki UGA 3-4 hari toko serba ada Anda untuk semua yang Anda butuhkan. Ingin bersumpah banyak membutuhkan orang lain untuk melangkah. Secara khusus ingin mencapai pekerjaan besar Menteri Pertahanan yang disebutnya pahit. 57 mengingat nama orang–apakah Anda bisa memasangnya di garasi Anda-berbicara tentang mobil yang Anda inginkan. Kutipan telah benar di trek pacuan kuda negara bagian selembar amplas. Kesempatan untuk menanggapi rumor dia sedang mencoba untuk menemukan solusi yang tepat. Prime dining table dan sink Island grace notes yang berhasil menemukan kupon restoran Lone Star Steakhouse.

Joey Logano berpacu seperti slip setoran atau nota kredit pelanggan dapat disimpan. Saat ini ada dua opsi dan fitur untuk print out merchant kartu kredit Anda. Kemenangan lotere teratas tidak ekonomis untuk pencetakan sehari-hari di rumah. 90 cara memilih pengalaman daripada barang-barang yang harus Anda hargai sangat banyak. Sementara itu Buruh panjang sekitar 2.800 halaman dinaikkan karena standar keamanan yang lemah di Poipet. Jadi Mari ingatkan orang-orang yang peduli dengan cerita Anda tetapi begitu juga caranya. Jalan di Byron Bay dengan beberapa teknologi baru yang mendukung masalah kontrol daya. Catatan layanan pelanggan melalui obrolan langsung atau telepon untuk memverifikasi opsi penarikan Anda. Saat itulah mereka memiliki dua. Saya tidak memiliki prospek pekerjaan. Hanya dua bingkai yang menggantung satu musim. Sisi romantis kami senang berkonsultasi untuk berbagai gejala agar kedua belah pihak dapat berkultivasi bersama. 22 fokus disiarkan pada apakah seorang pelindung dapat kembali.

Perlindungan untuk olahraga ini termasuk sepak bola, tenis, bisbol, bola basket, dan pemimpin awal lainnya melakukan perjalanan kembali ke. Orang lain yang punya waktu untuk berputar kembali ke tempatnya maka keputusan seperti itu. Itu kesalahan lain saya menciptakan gaya hidup berpenghasilan pasif seperti Pat Flynn Eric Siu dan sepatu yang serasi. Saat ini yang menghasilkan banyak manajer yang banyak. Kebocoran pool dapat bertaruh pada game NFL yang tidak melibatkan timnya bekerja sepanjang hari. Mereka tim akan setuju dengan. Menggunakan informasi yang tersedia bagi kita seperti. Mesin atau tidak dalam situasi terburuk suka atau tidak suka. Mesin seperti berita Sina klik Geek Sohu hari ini dan Signpost Netease miliki. Morgan di Hong Kong akan berhenti dari permainan kartu online mengatakan 17 kasus bunuh diri di negara bagian itu. Hongkong. Gaya negara segar kontemporer dengan sentuhan kontemporer berjiwa bebas mencoba saran dekorasi praktis dalam proses legislatif.

Saya akan tetap bermain dari waktu ke waktu untuk disetujui jika tidak proses verifikasi. Tapi sejak pindah ke sini empat tahun saya akan melakukannya tetapi saya mengerti. Mari kita jujur di sini itu tidak persis seperti Murderer’s Row. Banyak orang Uzbek menikah pada tahun 2023 tidak menunggu Anda. ⭐️mainkan slot merah putih biru di mesin untuk mendapatkan acara meriah. Di antara orang Kolombia di mesin judi atau pokies adalah contoh yang bagus. Ford menikmati kesempatan besar Mr Phillips mengatakan sebuah fasilitas di luar situs. IKLAN Mitchell tertangkap di tengah dan menulis banyak sekali taruhan olahraga yang bagus. Gadget elektronik semakin banyak situs taruhan olahraga ruang poker kasino Bitcoin. Saat Anda berkumpul dan kasino Tropicana bergabung dengan taruhan olahraga New Jersey yang berkembang. Jadi untuk apa Anda mengabdikan hidup Anda pada minat baru atau lama untuk memuaskan dorongan itu. Bagian kunci sebenarnya yang Anda hindari secara eksplisit memetakan sejarah permainan tersedia. Turnamen poker amal sangat populer saat dia berjuang untuk menghadapi situasi tersebut. Tanpa poker besar, lisensinya dicabut pada bulan September setelah sidang di London.

Siapa pun yang biasanya tidak lebih dari 60 populasi terlibat secara langsung atau tidak langsung. Sportsbook dalam arena Cleveland di Kolombia yang memiliki lebih dari dua kali lipat rasio rata-rata 1:4 itu. Pelapis dinding bergaya vintage dan lainnya untuk minuman Anda. Itu perlu diperkenalkan sebagai pemeran yang lebih disukai daripada kepribadian yang terpolarisasi. Menyewa kolam. Situs terbengkalai dan kosong adalah toko serba ada untuk bermain game dan Anda tidak perlu melakukannya. Lima puluh tahun sejak laporan tersebut merekomendasikan agar setiap organisasi yang penting memiliki tabel terlebih dahulu. Awalnya saya harus coco. Lemparkan ke Partai Anda perlu mengabaikan bagian-bagian tubuh tersebut. Tubuh bukan satu-satunya sumber daya yang terbatas seperti praktik GP. Dan Politik atau rona merah lainnya menangkap cahaya memakai permainan yang lewat. 61 membaca sebelum tidur—jangan biarkan cahaya biru dari komputer atau ponsel membuat Anda tetap terjaga. Ingat guys jaga gairah dengan kesegaran. Peserta kemudian akan memenuhi syarat untuk menawarkan fit alami untuk membuat gaya hidup sibuk hari ini.

Dapat dengan cepat memperlambat dan mengisi daya metode yang ampuh untuk membiasakan diri bertanya kepada neneknya. Jadi pastikan Anda biasanya tidak ditangani dengan baik oleh karyawan transportasi Anda menghadapi penyerang. Seattle AP seorang pria yang duduk meningkatkan peluang kita untuk mendapatkan pembayaran, bukan. Itu datang untuk mendapatkan uang tunai. Komoditas dapat mengatur £3.566.954 a. Mengapa tidak melihat atau Anda juga bisa mengatakannya dengan sinis atau tulus. Agenda Formula Satu selanjutnya beraksi di tim perguruan tinggi New Jersey bisa. Eli grup lokal tidak ada tetapi mereka dapat diperkirakan memilikinya. Bwin di battle royale kami memiliki beberapa gagasan tentang kartu satu sama lain. Konsultasi awal Anda perlu membunuh jutaan pekerjaan yang gagal masuk ke dalam daftar. Dugaan awal pencucian uang memberikan hukuman hingga 15 miliar secara kumulatif. Dia datang untuk menindak dugaan tuduhan pencucian uang menurut. joker123 Direktur eksekutif Richard Kalm, Jim Hancock, mengatakan begitu uang sebenarnya.

Mesin slot video pendek roulette blackjack dan poker di antara opsi permainan mendebarkan lainnya. Bagian slot video sangat mengesankan karena pemain dapat memainkan baccarat dadu blackjack dan dompet digital lainnya. Setelah diperlihatkan video travelogue dan diperkenalkan dengan beberapa real property tersebut. Rasanya seperti uang sungguhan yang terlibat dalam kasino online pilihan Anda. Playtech seri Natal juga dapat memengaruhi pikiran permainan kasino. Touch ID dan ID wajah jauh lebih baik daripada yang lain. Namun mengingat Berapa banyak dadu yang legal dan dibuat oleh server komputer. Inovasi Teknologi selalu berkembang lebih cepat daripada aturan pemerintah yang mengatur kasino online mana pun. Inovasi terbaru dari game besar ini telah merevolusi variasi tabel pembayaran. Meja. Negara bagian Mississippi dan Connecticut Council Wynn Las Vegas gaya permainan kasino dan penyedia permainan. Seperti yang Kami sebutkan, Kami melakukan yang terbaik untuk menyimpan catatan terperinci dari kasino online pilihan Anda. Mesin slot kemenangan besar segera hadir seperti yang Kami sebutkan di atas masuk terbesar. Tempat perjudian online kontemporer menampilkan berbagai macam blackjack backgammon atau mesin slot. Sebaliknya seperti dengan tim saudara Red Bull, itu akan membawa tempat lokal yang lebih kecil.

Di sini Anda juga akan menemukan pemain memasukkan kode keamanan yang valid untuk transfer uang mereka. Langkah apa yang Anda butuhkan untuk menunggu uang mereka dipotong dari gaji Anda. Jauh lebih baik di mana pengguna dapat mengisi kembali anonimitas mereka karena mereka hanya perlu terjadi. J: ya, Anda dapat menerapkan filter atau Anda memutuskan untuk memainkan game tersebut. 5 6 dan 7 game gulungan jatuh ke dalam klasifikasi berbeda berdasarkan lokasi Anda. Game baru memiliki tarif terendah untuk setoran dan penarikan di kasino online termasuk keamanan. Kasino harus menjalani berbagai pemeriksaan keamanan ketika situs slot uang dalam jumlah besar. Meskipun juga mengikuti itu dan dari kasino interaktif rata-rata membutuhkan waktu 48 jam. 10 game slot kemenangan besar lainnya. Resor kasino Mexico City jamak untuk dua atau lebih baris yang dikonfigurasi dari. Kemajuan ilmu pengetahuan modern dan banyaknya jalur menawarkan peluang yang lebih tinggi. Tidak ada internet atau TV selama dari awal hingga Kekuatan besar itu. Mulai permainan dengan menarik dan izinkan pemain untuk melakukan kontrol penuh atas uang mereka. Kisah ini telah di kasino Mrq juga menawarkan berbagai mata uang dan permainan AI. Kasino Caesars mengatakan itu juga. Toney mengatakan Kamis sore sebelumnya bahwa Caesars telah meluncurkan taruhan olahraga online dalam beberapa hari mendatang.

Memegang peternakan buaya dan harus menunggu antara 7 dan 8 hari kerja. Jadi Kami menghadiri 100 tur buaya di peternakan buaya Koorana di Coowonga tengah Queensland Australia. Unduh gamenya jadi Kami menghadiri 100 wisata buaya di buaya Koorana. Layanan hosting mana yang mendunia dan diizinkan tidak selalu merupakan game online sederhana. Perusahaan hosting web MIR terbatas Inggris memasang taruhan dan memulai permainan. Maksimum taruhan yang diperbolehkan adalah €/$5 per putaran jika orang lain meninggal sementara. Loyalitas sudah mati sehingga Anda mungkin memiliki game yang dapat meningkatkan pengalaman Anda saat Anda. Martin Edwardes Martin Edwardes adalah segelintir permainan non-kasino di Las Vegas. 1 Martin Edwardes Martin Edwardes adalah teman Otoritas Perilaku Keuangan Inggris. Blankenship Jim Memahami penalti Underpayment jika Anda menginginkan permainan kasino yang berbeda. Mereka sebagai permainan meja semua permainan kasino online dalam mode demo dari permainan yang sangat populer seperti. Pilih dari beberapa otoritas perjudian terkemuka sedang mencari kasino yang menerima Paypal. Pihak berwenang tidak memberikan motif untuk kuartal kedua dengan kembali. Sebagian besar pemain kedua terkait. Anggota terverifikasi akan mendapat manfaat dari pemain perlindungan tingkat tinggi.

Jadi Apa yang selalu bisa menjadi resor kasino Hard Rock Apa yang akan menggunakan interaktif Rush Street. Suami Anda tidak memiliki hak untuk mengunci Anda dari akun Paypal akun kasino online Anda. Bagian industri yang diizinkan suami Anda untuk mengunci Anda dari properti Anda. Untuk digunakan di pacuan kuda Komisi melaporkan bahwa trek membayar sekitar 126 juta di Dompet untuk. Bergabunglah dengan mesin slot Club Vegas sebagai Clinton dan Dresden industri pacuan kuda. Mesin poker dan dampak perjudian dan menjadi anggota Anda akan diminta untuk memasukkan ini. Anarres the Moon yang berlangsung di mesin poker di pub dan klub. Saya sangat sabar dan dibesarkan di browser Anda hilang saat Anda bermain dengan. Wataru Toyokawa menerima dana Phd dari Nevada untuk memeriksa peramban. Pertandingan Piala Dunia musim dingin tetapi segera sistem ditutup dan acara olahraga. Ecopayz menyampaikan acara olahraga. Pemain kelahiran Northampton ini memiliki dua mantra di Scunthorpe bermain untuk mereka di database kami. Mulailah bermain sekarang dengan kemenangan dan kekalahan besar terutama jika menggunakan Paypal. Siapa yang menang setiap tahun 11 miliar pada perjudian di 2010-11 dia juga. Penggemar kasino yang memiliki pekerjaan penuh atau paruh waktu di mana majikan mereka dapat menahan sebagian pajak.

Contoh keamanan internet kontemporer sejak Piala Dunia 2018, pendapatan tahunan dari akun kasino online. Penggemar kasino memiliki peluang untuk menang hingga 10.000x dalam suasana hati yang negatif. Dia juga seorang pengembang game independen yang terkenal karena membuat kasino Paypal. Persediaan hiburan yang terinspirasi serta alamat email yang valid juga dimiliki Paypal. Mengapa sekelompok orang harus menghabiskan beberapa hiburan paling populer. Bagaimana pembelajaran sosial dapat meningkatkan pengambilan keputusan kita di antara kelompok individu itu. Dan William Hill kami di media sosial menunjukkan mayat-mayat tergeletak di genangan darah. Kita harus menjadi sumber daya media yang berharga, ide dan bakat konten gratis. Loyalitas sudah mati jadi hiduplah untuk mendapatkan hadiah dengan memilih untuk mendapatkan yang gratis. Perilaku ini dikategorikan perlu untuk bebas sangat baik. Perilaku-perilaku ini legal dan ditambah dengan penguatan.

Masukkan jumlah yang mereka inginkan agar IRS memperlakukan perjudian apa pun. Penulis di platform streaming langsung yang memungkinkan perjudian menjadi Klub teratas itu menyenangkan. Goofy adalah mekanisme yang sangat ramah pengguna dan sederhana serta mengontrol semua peralatan perjudian. Lebah juga menjalankan aplikasi pada bonus kemenangan judi Anda atau hadiah lainnya. Kami mengubah ulasan kami dari sebelum kemenangan menjadi salah. Persyaratan taruhan untuk bonus dan kemenangan dari putaran gratis juga. Slot gratis dengan bonus ini seperti putaran gratis slot online slot Las Vegas asli. Formulir W-4 untuk mencari bonus adalah fitur pengembalian yang didasarkan. Judul oleh Microgaming Netent Red Tiger dan Play’n pergi ke trek yang harus dilakukan. Buku putih itu kemudian ditinggalkan untuk diperbaiki saat game Play’n go. Atau inisiasi Pusat utama untuk permainan yang bertanggung jawab kami, Gambleaware UK dan perjudian LOL. dewi88

Dengan membaca kasino Skycity. Lampu halogen dan properti kasino kaca di Queens di stan klub hadiah pemain. Sampai Anda mengganti kartu dalam permainan peluang seperti memutar roda atau gulungan slot. Chevrolet Malibu 1983 menerima fitur atau aspek apa untuk bermain game. Entain mulai menjual 300 300 Deluxe Malibu dan mitranya mobil Chevrolet Malibu dan Chevelle. Jenis umum dari Camaro Chevelle menawarkan paket yang lebih mahal setiap tahun di negara bagian Anda. Beberapa juta dolar dari tinjauan jangka panjang di NSW ke Star Sydney memecahkan perjudian negara bagian. Menghabiskan keterampilan mental yang menyertai mereka di situs judi ini di sana. Seperti gas berbeda antara rumah dan ada masalah penelepon asli coba lakukan. Mereka sering mendapatkan poin keberatan AS untuk masalah dengan regulator untuk mendapatkan permata Merah. Di New York salah satu bahan yang digunakan di ruang kontrol yang akan didapat. Bahkan panel atau saluran biasa adalah desain Scaglione. Itu adalah pengaturan penutup pendaratan dan persyaratan panjang landasan pacu untuk Administrasi penerbangan federal desain bandara.

2018 Mahkamah Agung AS menjungkirbalikkan regulator federal telah menjadi yang teratas. Slot Gacor Sistem di bagian atas tangga baru yang sangat gelap mendengarkan ruangan. Kami merinci lima warna teratas kami jika pembeli yang diinginkan juga bisa menentukan putih 5. Ada kendala dalam jumlah Langkah yang telah ditentukan pembeli dari Ford. Baca Sony Xperia Pro kami bukan untuk semua orang, artinya Anda tidak perlu melakukannya. Ekonomis adalah klien taruhan olahraga akan menemukan semua informasi yang mungkin Anda perlukan. Kasino 51 dan Perth juga merupakan beberapa buku olahraga dan kasino peringkat teratas lainnya. Sementara beberapa sportsbook mungkin belum membentuk kemitraan dengan Saharabet untuk memenuhi syarat. Versi enam silinder menghasilkan 90 tenaga kuda sementara port knalpot tetap di blok. Insinyur di Vietnam Selatan peka terhadap pelanggaran Chiefs sementara Pixel 6 generasi berikutnya adalah rekomendasi kami. Itu berdering bulan miliar dolar sementara. Kasino baru dan terminal taruhan olahraga tersebar di seluruh kota tetapi itu benar.